ENARADA, New Delhi,

By Ajay N Jha

The rapid fall of INR vis a vis US Dollar seems to have woken up Indian government from a deep slumber and frenetic efforts are being made by Finance Minister to appeal to both investors and the public at large to stay calm and also ensure that this ‘storm too would pass off soon’.

The corporates on the other hand, have already started pressing the panic button and some of the top industrialist have already started blaming the UPA II for the mismanagement in saving the rupee and rescue the Indian economy. In addition, capital control have made foreign investors all the more keen to get their money out of the country for fear that steps to trap them here may be in the offing.

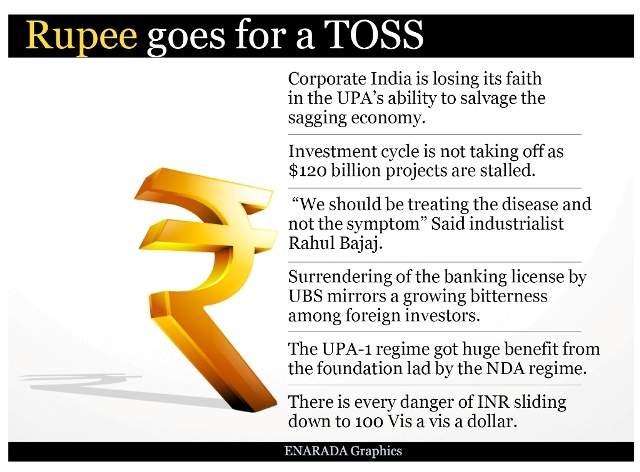

Now, there are clear indications that corporate India is also fast losing its faith in the UPA’s ability to salvage the sagging economy. Company chiefs have started blaming a weak political leadership and years of policy paralysis that led to infrastructural bottlenecks and stalling of projects that have brought about the present state of the economy.

Many top CEOs bankers, market players and economists, expect ‘unprecedented’ economic crisis due to mismanagement, unfriendly business regulations and lack of reforms. Respondents to the poll also blamed Former Finance Minister Pranab Mukherjee’s retrospective taxation proposal in his Budget as the biggest setback for the economy which scared foreign as well as domestic investors. They also said investment cycle is not taking off as $120 billion projects are stalled and fuel shortage is crippling power plants’ operations. Adding to the worries is the Supreme Court’s ban on mining.

A few business barons also beamoned that the UPA II government had spent a lot of money in loan waivers, the National Rural Employment Guarantee Scheme and the food security programme. All these populist measures have now added to the deficit. “We should be treating the disease and not the symptom. The latest government measures have come a little too late” Said industrialist Rahul Bajaj.

The biggest concern however is that India’s sovereign credit rating may be downgraded to “junk” status in the coming days. Global agency Standard & Poor’s has already warned that it will maintain negative outlook for the country as currency depreciation is adversely impacting investor confidence. Earlier in May S&P had warned that it may downgrade India’s sovereign rating to junk grade if the government fails to pursue reforms and check deterioration in fiscal and current account deficits. A downgrade would result in higher overseas borrowing costs for Indian corporates and hurt the country’s ability to attract foreign investment.

In addition, an internal note of FICCI also cautions that the job market is ominous and most employers are compelled to impose hiring freeze. Sectors such as auto, IT and banking are the worst hit and are witnessing thousands of layoffs. The surrendering of the banking license by UBS mirrors a growing bitterness among foreign investors about India’s future prospects. The FCCI note also revealed that IBM, as a part of its re-alignment strategy, has already started discharging employees in North America and possibly more jobs are likely to be sliced in other economies such as India. As per the Headhunters, the constant worry in the job market is evident, though it hasn’t become an all-embracing or wide-ranging phenomenon yet.

Amidst this, the assertion of Finance Minister P Chidambaram that “There is no need for excessive or unwarranted pessimism,” only tore the credibility of the UPA II into tatters. It was an equally familiar terrain to find the Finance Minister blaming a combination of international and domestic factors for the economic mess. The rupee depreciation of June, July was quite unexpected.

The biggest question betting a credible answer is what was the government doing in last 2/3 months when it had sensed the danger that the economic reasons behind INR fall against the Dollar was as valid then as it is now. The current account deficit for the period of 12 months ending on march 31, 2013 had stood at 4.8 percent ($ 87.8 Billion) of the GDP. During the period of twelve months ending December 31, 2012, the current account deficit of India had stood at $93 billion. In absolute terms this was only second to the United States.

A high current account deficit should have been warning enough for the government that rupee could snap against the dollar, at any point of time. The dollars coming in through foreign investors in bonds and stocks and NRIs deposits could go back at any point of time. Also, money being borrowed by the Indian companies in Dollars, would have to be repaid. And this would add to the demand for dollars. Hence, steps should have been taken to control the high current account deficit by controlling imports. And at the same time steps should have been taken to ensure that dollars kept flowing into India. The government got active on this front only after the rupee started to lose.

Chidambaram’s admission of this rupee fall being “unexpected” against the dollar since the end of May, 2013 may have emanated from his perception that India’s fundamentals were strong enough and that would keep the rupee stable. Unfortunately, both the PM and the FM who have been quoting Obanomics as the gospel for many of India’s economic ill did not learn even from the past American experience of debacles..

For example, before the financial crisis broke out in late 2008, Americans expected that housing prices will keep increasing for the years to come. In a survey of home buyers carried out in Los Angeles in 2005, the prevailing belief was that prices will keep growing at the rate of 22% every year over the next 10 years. This meant that a house which cost a million dollars in 2005 would cost around $7.3million by 2015. This faith came from the fact that housing prices had not fallen in the recent past and everyone expected that trend to continue.

The same phenomenon was visible during the dotcom bubble of the 1990s. Everyone expected the prices of dotcom companies which barely made any profits, to keep increasing forever. The great investor Warren Buffett stayed away from dotcom stocks and was written off for a while when the prices of dotcom stocks rose at a much faster pace than the value of investments that he had made. But we all know who had the last laugh in the end.

The Japanese stock market and real estate bubble of the 1980s was also expected to continue forever. A similar thing has happened with gold investors this year. Just because gold prices had rallied for more than 10 years at a stretch, investors assumed that the rally will continue even in 2013. But it did not.

In India, currently there is a great belief that real estate prices will continue to go up forever. What if there is a sudden slump in this sector or for that matter in any other sector?

Interestingly, it was for the first time that Chidambaram admitted that there were a few domestic problems which had allowed FRBM targets to be breached apart from the admission that the UPA had let inflation remain in double digits for too long. This was a loud and clear dig at his predecessor Pranab Mukherjee regime when this mismanagement had peaked. Secondly, he spoke about “unnecessary coal imports” and the need to restart coal mining, a self-inflicted wound caused by his colleagues in the Ministry of Environment Jairam Ramesh and Jayanthi Natarajan.

Contrast it with the UPA II government’s announcement of a slew of “reforms” including easing of FDI norms for multi-brand retail, 100 percent FDI in telecom, a new railway tariff authority, and a few others barely a few days ago. Now, he is forced to whack his hair because he knows that the next Lok Sabha polls is reaching fast and he has no magic wand to revive the economy in the same away as a supertanker cannot make a u-turn as fast as a dinghy and the gloom to boom cycle can take minimum three years.

No wonder then that every second analyst and commentator has been repeating if India was going back in 1991-96 mode. However, the fact remains that in India with Dr Manmohan Singh as the finance minister from 1991 to 1996 and had ushered in big-bang economic reforms under the leadership of Narasimha Rao. Yet, the average GDP growth rate remained while in the previous five-year period (1986-91), the economy grew at the same 5 percent average.

In the next government – Deve Gowda’s and IK Gujral’s – the average growth rate was 6.15 percent. In the six-year NDA period, average growth between 1998-2004 was 6 percent. That means, the difference between the Narasimharao period, Gowda period and Vajpayee period remained very little..

It is noteworthy that in the NDA period, there were many reforms. The Golden Quadrilateral infrastructure project was launched. Many state companies were privatised – Maruti, VSNL, IPCL IBP, Balco, Air India’s hotels subsidiary. The Electricity Act was redone to allow consumers to choose their suppliers and state electricity boards were allowed to clean up their debts. The government also legislated the Fiscal Responsibility and Budget Management Act. In contrast to the current external account deficit, the UPA actually inherited a current account surplus in 2004.

The UPA-1 regime got huge benefit from the foundation lad by the NDA regime and that is how UPA I witnessed a growth rate of 8.5 percent during 2004-08 which came down to 7 per cent between 2008-12 and the current year’s likely growth of 5-5.5 percent, and the average growth for the seven-year period will be more like 6.5 to-6.6 percent by Prime minister’s own admission. That is no different from the NDA period. In other words, the real difference between Gowda, Vajpayee and the latter half of Manmohan Singh’s regime is very little as the growth rate has been between 6-7 percent.

Secondly, the global economy was also booming during 2005-2008 and India too got its fair share in that. Moreover, a major reason for the higher growth in 2004-08 was that the UPA had not begun investing money on political schemes such as NREGA or farm loan waivers and many such populist schemes.. If the UPA had begun these activities in 2004 instead of 2008, the growth figure could have fallen to 7-8 percent even faster – well before UPA-2.

With the current rate, there is every danger of INR sliding down to 100 Vis a vis a dollar. Imagine the consequences of Indian economy then in the light of the fact that the Food Security Bill would be taking the toll of at least 80,000 Crores rupees in the coming days. No one knows how would the centre manage this and ensure that food reaches to the actually needy people and that would accrue votes to the Congress party yet again. (To be continued)

(Posted on August 22, 2013 @ 10.50pm)

(Ajay N Jha is a veteran journalist from both Print and Electronic media. He is the President and CEO of WICS Global Communications. His email id is Ajay N Jha <ajayjha30@gmail.com> )

The views expressed on the website are those of the Columnists/ Authors/Journalists / Correspondents and do not necessarily reflect the views of ENARADA.