ENARADA, New Delhi

By Ajay N Jha

A Congress functionary in charge of Media Monitoring at AICC Communications department wrote on facebook ”The Food Security Bill and the Land acquisition Bills are the two jewels in the Congress crown. Together these two Bills will provide right to food and right over their land to all the poor and downtrodden in the country.” Immediately after that, there was another party functionary who defended Congress President saying that ”this should be a lesson for we Indians that our home grown politicians could think of such a scheme while a lady who was not born in India, could still think about the plight of the poor in this country and force UPAII government to give them at least food security”.

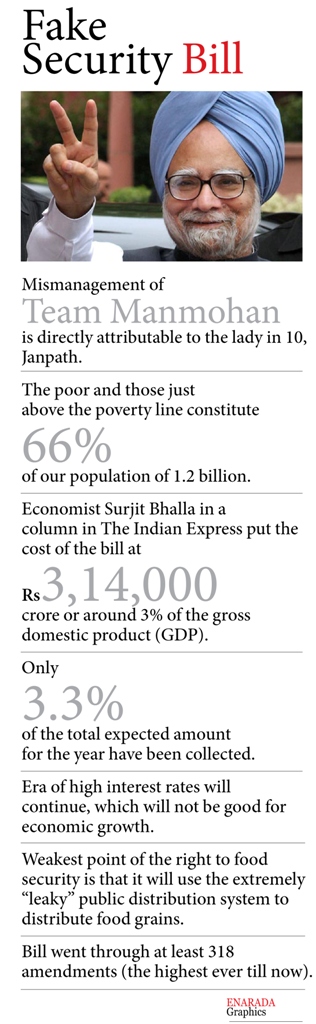

There were a few others who said that a few Congress functionaries want us to believe that the mismanagement of Team Manmohan is directly attributable to the lady in 10, Janpath. She pulls the strings to promote her crazy schemes and the PM capitulates leaving behind all the good economics he learnt at Oxbridge. Indeed, the viciousness with which the Congress president has been attacked, courtesy the fall of the rupee, is simply bizarre. All the accumulated venom against her “populism” which has been festering since the UPA came back to power has arisen with a vengeance.”

Amidst all that came the stout defence of Outlook editor Vinod Mehta who said “Populism has always received bad press. These days it is emerging as the ultimate national sin. And it is personified in the politics of Sonia Gandhi. I could fill a whole page of the Times of India with a laundry list of the sins credited to Sonia and her apparently perverse brand of populism”.

As is known, Sonia’s populism lays great emphasis on welfare spending for the poor. Whatever the merits of the numbers, the poor and those just above the poverty line constitute 66% of our population of 1.2 billion. Even if you admit that part of the welfare spending leaks, even if you admit that it puts pressure on the exchequer, is trying to give 66% of our citizens a slightly better life anti-national?

Of course, there are electoral calculations in the populism. So what? If providing half-way decent food, shelter and education for those who live on the margins helps to gather votes for the Congress party, good luck to it. After all, Sonia Gandhi has not yet patented “sops”.

Mehta may be right to some extent yet the fact remains that the truth behind this ambitious Food Security Bill lies somewhere in the middle. It would be for history to judge if this was a boon which could change the lives of millions through this ’dole’ or it was the biggest ‘political blunder’ in recent times.

There are a few points which this government seriously needs to ponder over. The government estimates suggest that food security will cost Rs 1,24,723 crore per year. But that is just one estimate. Andy Mukherjee, a columnist with Reuters, puts the cost at around $25 billion. The Commission for Agricultural Costs and Prices(CACP) of the Ministry of Agriculture in a research paper titled National Food Security Bill – Challenges and Options puts the cost of the food security scheme over a three year period at Rs 6,82,163 crore. During the first year the cost to the government has been estimated at Rs 2,41,263 crore.

Economist Surjit Bhalla in a column in The Indian Express put the cost of the bill at Rs 3,14,000 crore or around 3% of the gross domestic product (GDP). Ashok Kotwal, Milind Murugkar and Bharat Ramaswami challenge Bhalla’s calculation in a column in The Financial Express and write “the food subsidy bill should…come to around 1.35% of GDP, which is still way less than the numbers he (i.e.,Bhalla) put out.”

The receipts of the government for the year 2013-2014 are projected at Rs 11,22,799 crore. The government’s estimated cost of food security comes at 11.10%(Rs 1,24,723 expressed as a % of Rs 11,22,799 crore) of the total receipts. The CACP’s estimated cost of food security comes at 21.5%(Rs 2,41,623 crore expressed as a % of Rs 11,22,799 crore) of the total receipts. Bhalla’s cost of food security comes at around 28% of the total receipts (Rs 3,14,000 crore expressed as a % of Rs 11,22,799 crore).

The cost of food security expressed as a percentage of total receipts of the government is likely to be even higher. This is primarily because the government’s collection of taxes has been slower than expected this year. The CAG report is pointedly hinting towards this. For the first three months of the financial year (i.e. the period between April 1, 2013 and June 30, 2013) only 11.1% of the total expected revenue receipts (the total tax and non-tax revenue) for the year have been collected.

When it comes to capital receipts (which does not include government borrowings) only 3.3% of the total expected amount for the year have been collected. What this means is that the government during the first three months of the financial year has not been able to collect as much money as it had expected to. This means that the cost of food security will form a higher proportion of the total government receipts than the numbers currently tell us.

Moreover, the government estimate of the cost of food security at Rs 1,24,723 crore is very optimistic. The CACP points out that this estimate does not take into account “additional expenditure (that) is needed for the envisaged administrative set up, scaling up of operations, enhancement of production, investments for storage, movement, processing and market infrastructure etc.”

Food security will also mean a higher expenditure for the government in the days to come. A higher expenditure will mean a higher fiscal deficit. Fiscal deficit is defined as the difference between what a government earns and what it spends. Given that the economy is in a breakdown mode, higher taxes are not the answer. The government will have to finance food security through higher borrowing.

Higher government borrowing by the government crowds out private borrowing. The private sector (be it banks or companies) in order to compete with the government for savings will have to offer higher interest rates. This means that the era of high interest rates will continue, which will not be good for economic growth.

Also, it is important to remember that the food security scheme is an open ended scheme. There’s no expiry date and no sunset clause. It covers around two-thirds of the population—even those who are not really needy. This means that the outlays will have to increase as the population grows.

This might also lead to the government printing money to finance the scheme. It was and remains easy for the government to obtain money by printing it rather than taxing its citizens. F P Powers aptly put it when he said that money printing would always be “the first device thought of by a finance minister when a large quantity of money has to be raised at once”. History is full of such examples.

Money printing will lead to higher inflation. Prices will rise due to other reasons as well. Every year, the government declares a minimum support price (MSP) on rice and wheat. At this price, it buys grains from farmers. This grain is then distributed to those entitled to it under the various programmes of the government.

The grain to be distributed under the food security programme will also be procured in a similar way. But this may have other unintended consequences which the government is not taking into account.

Higher food prices will mean higher inflation and this in turn will mean lower savings, as people will end up spending a higher proportion of their income to meet their expenses. This will lead to people spending a lower amount of money on consuming good and services and thus economic growth will slow down further. It might not be surprising to see economic growth go below the 5% level.

Lower savings will also have an impact on the current account deficit. If India does not save enough, it means it will have to borrow capital from abroad. And when these foreign borrowings need to be repaid, dollars will need to be bought. This will put pressure on the rupee and lead to its depreciation against the dollar.

There is another factor that can put pressure on the rupee. In a particular year when the government is not able to procure enough rice or wheat to fulfill its obligations under right to food security, it will have to import these grains. But that is easier said than done, especially in case of rice. Rice is a very thinly traded commodity, with only about 7 per cent of world production being traded and five countries cornering three-fourths of the rice exports. This will lead to increased demand for dollars and pressure on the rupee.

The weakest point of the right to food security is that it will use the extremely “leaky” public distribution system to distribute food grains. As Jagdish Bhagwati and Arvind Panagariya write in India’s Tryst With Destiny – Debunking Myths That Undermine Progress and Addressing New Challenges “A recent study by Ramaswami estimates that in 2004-05, 70 per cent of the poor received no grain through the pubic distribution system while 70 per cent of those who did receive it were non-poor. They also estimate that as much as 55 per cent of the grain supplied through the public distribution system leaked out along the distribution chain, with only 45 per cent actually sold to beneficiaries through fair-price shops. The share of food subsidy received by the poor turned out to be astonishingly low 10.5 per cent.”

Estimates made by CACP suggest that the public distribution system has a leakage of 40.4%. ‘In 2009-10, 25.3 million tonnes was received by the people under PDS while the offtake by states was 42.4 million tonnes’ indicating a leakage of 40.4 percent.

With the subsidy on rice being the highest, the demand for rice will be the highest and the government distribution system will fail to procure enough rice. The jhollawallas’ big plan for financing the food security scheme comes from the revenue foregone number put out by the Finance Ministry. This is essentially tax that could have been collected but was foregone due to various exemptions and incentives. The Finance Ministry put this number at Rs 480,000 crore for 2010-2011 and Rs 530,000 crore for 2011-2012.

But this number is a huge overestimation given that a lot of revenue foregone is difficult to capture. Finance minister P Chidambaram pointed out in his budget speech this year that “There are 42,800 persons – let me repeat, only 42,800 persons – who admitted to a taxable income exceeding Rs 1 crore per year”.

It is well known that Many Indians do not like to pay tax voluntarily. And just because a tax is implemented does not mean that they will pay up. This is an after effect of marginal income tax rates touching a high of 97% during the rule of Indira Gandhi. A huge amount of the economy has since moved to black, where transactions happen but are never recorded.

At the end of the day, food security will turn out to be a fairly expensive proposition for India. On the hindsight, perhaps the advisors of this Bill may have not explained all the pitfalls and implications to the Congress President before going ahead with this proposition. With this Congress has firmly gone back to the “garibi hatao” politics of Indira Gandhi.

It is all the more shocking that the passage of this bill went through at least 318 amendments (the highest ever till now). Does that mean, the core advisors of the Congress President were just trying to please her or they just did not muster up enough courage to explain her a few things rationally before taking a plunge? The Congress President may not herself be an economist. But with this Bill, She appears to have ended up imitating her politics and her economics further without actually assessing both short and long term implications of such a stupendous task.

(Posted on September 1, 2013 @ 10.05pm)

(Ajay N Jha is a veteran journalist from both Print and Electronic media. He is the President and CEO of WICS Global Communications. His email id is Ajay N Jha <ajayjha30@gmail.com> )

The views expressed on the website are those of the Columnists/ Authors/Journalists / Correspondents and do not necessarily reflect the views of ENARADA.